One thing is certain these days: Home and auto insurance rates are higher than ever. Not only are premiums increasing across the country, but many carriers are cutting back on available limits and mandating risk management or safety tracking protocols, such as indoor leak-detection devices and driver-behavior tracking apps. Some insurers are even pulling out of risk-prone areas like Florida and California, leaving individuals

and families with fewer choices and steeper prices.

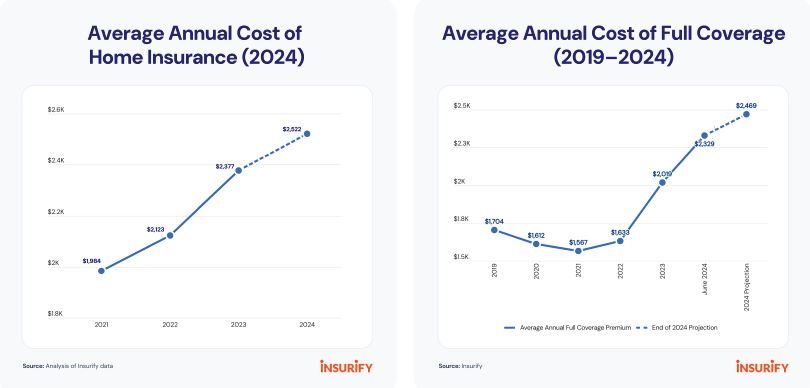

With a 6% increase in homeowners’ premiums expected for 2024 — on top of a 20% increase over the prior two years¹ — and a 51% increase in auto insurance rates over the past three years,² it is no wonder home and vehicle owners are looking for answers to why this is happening and exploring ways to mitigate those costs.

What’s behind the increases?

Every insurer has its own set of underwriting guidelines and appetite for insurance in various locations. However, many experts agree that the growing cost of homebuilding supplies and repairs, rise in claims litigation, and escalating frequency of extreme weather events are behind the increase in homeowners’ insurance premiums. Similarly, weather-related claims, high replacement and repair costs, overall rising accident rates, and sky-rocketing medical expenses from accidents are working to boost auto insurance costs.

Explained in a recent article in the Insurance Journal, the surge in premiums started back in 2017, when Hurricane Irma made landfall in Florida. This hurricane caused an estimated $50 billion in combined property and recovery costs and was followed by California’s costliest wildfire season on record at the time, with an estimated $18 billion in damages. Incredibly, wildfire damages of 2018 were estimated at $26 billion, followed by 2020 and 2021, which surpassed that amount by some metrics, including total acres burned.³ While insurers have always understood that Florida and California posed greater risk, the article surmises that insurers were not ready for these unusually high claim years, had underpriced policies, and included contract language such as “unlimited” loss of use, undermining their ability to cover these unexpectedly high costs.

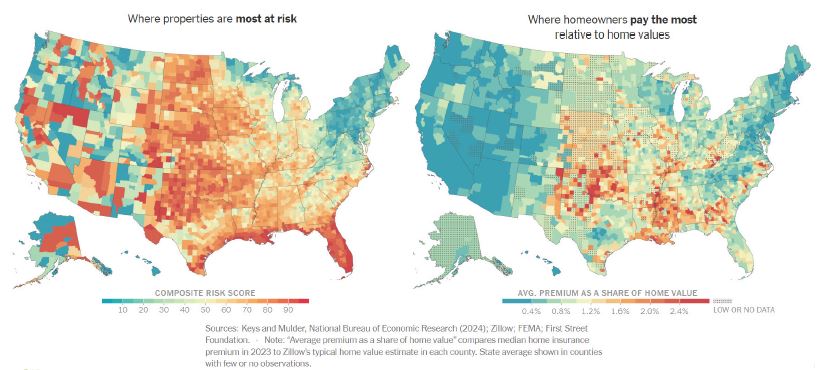

While broader industry and economic trends such as reinsurance rate increases, manual labor shortages, auto part scarcity, and increased legal costs have impacted insurance prices, successful individuals and families often reside in areas with increased climate risk, intensifying the pressure for insurers to increase premiums.

Why some areas are expensive despite lower risk

Not all experts believe that higher risk equates to higher premiums, however. In this New York Times article, research shows that in some places, homeowners are paying more than twice as much for insurance, as a share of home value, than people who live elsewhere (in a neighboring state) but face similar risk exposure.

This research offers several explanations for the discrepancy. For example, higher home insurance rates may be seen in rural states where there are fewer homeowners to share the risk, states in which there is more insurance fraud, and states in which regulators typically accept an insurer’s requests for rate increases. Another factor that can affect premiums is whether a state has a government-mandated, high-risk pool of insurance

for homeowners (i.e., wind or wild fire coverage) who cannot find private coverage. The two-thirds of states that have this pool typically have lower overall rates.

What can you do?

To potentially lower your homeowner and auto insurance premiums, consider these tips:

Review your insurance with your broker

Do you have the right coverage? Have you amended your deductible to keep up with inflation? Have you added all the risk mitigation measures to lower your premium as much as possible? Did you bundle auto and home with the same carrier to maximize discounts?

Look for discounts

For a home, this can mean adding protections, like installing a water leak-detection device to prevent interior water damage, dual-pane windows with tempered glass to better withstand wildfire-induced breakage, or impact windows and hurricane shutters to protect against flying debris from high winds. For auto insurance, consider signing up for a driver-behavior tracking app to prove to your insurer that you and your family members are safe drivers.

Raise your deductible

Your deductible is the amount you’re responsible for paying before your insurance company pays on a claim. If your portion is higher, your rates may be lower.

Consider your credit

In most states, insurers will look at your credit history when calculating your insurance premiums. If yours is low, consider ways to improve it, which can in turn lower your premiums.

If you have questions or would like to explore ways to keep your insurance rates in check, contact your Hilb Group professional today.

Sources

1. “States Where Home Insurance Costs Are Surging Highest,” REALTOR Magazine, May 20, 2024

https://www.nar.realtor/magazine/real-estate-news/states-where-home-insurance-costs-are-surging-highest

2. “We Tried to Shop Our Way to Cheaper Car Insurance. It Didn’t Work.,” The New York Times, September 30, 2024

https://www.nytimes.com/2024/09/28/business/cheaper-car-insurance-shopping.html

3. “HNW Market Update: What Went Wrong and How We Are Turning Things Around,” Insurance Journal, August 19, 2024

https://www.insurancejournal.com/magazines/mag-features/2024/08/19/788744.htm